san francisco payroll tax rate 2021

2021 ended with hotel occupancy at 572 percent in Wake County up 297 percent from the year prior. The following is adapted from remarks by the president of the Federal Reserve Bank of San Francisco at the Shadow Open Market Committee Conference held at Chapman University in Orange CA on June 24.

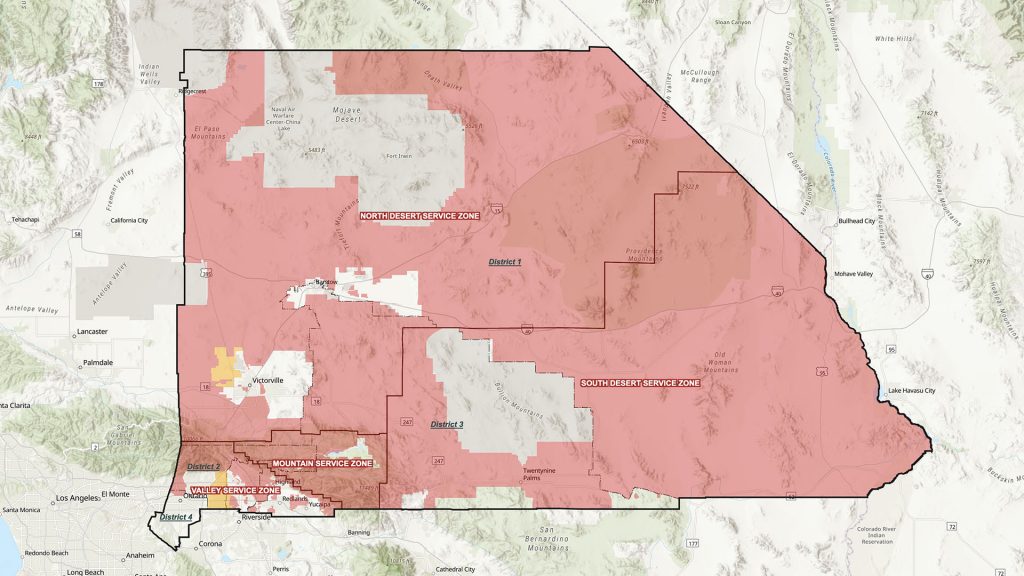

San Bernardino County Fire Protection District

2022-26 payroll and tax tracker.

. The tax rate is based on withholdings chosen on the employees W-4 form. Shelby Miller rhp 1. Decreases the Business Registration Fee for most businesses with San Francisco gross receipts up to 1 million.

The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. The average daily rate for hotels was 9703 in 2021 up from 8670 in 2020. In addition the bills will reduce the states top income tax rate for residents individuals trusts and estates from 55 to 49 in 2022.

Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. Austin County collects on average 13 of a propertys assessed fair market value as property tax. The labor force participation rate payroll employment and the share of job losers among the unemployed have provided more reliable signals.

The median property tax in Austin County Texas is 1903 per year for a home worth the median value of 146500. For example if you are single and have 50000 in taxable income after claiming the standard deduction you will have a 24 marginal tax rate. California has just one local taxing jurisdiction.

210566 approved August 4 2021 effective September 4 2021. 220756 approved August 4 2022 effective September 4 2022. To find the average premium for the small group market in a rating area for tax years beginning in 2021 see the average premium tables at the end of these instructions.

Payroll tax rates change yearly especially state tax rates and you must keep track of them to calculate your tax obligations. Contact your local tax authority to find out more about paying taxes in your city. The partial exemption rate is 39375 making partial sales and use tax rate equal to 45625 for San Francisco County and 53125 for South San Francisco San Mateo County.

The sales and use tax rate is determined by the point of delivery or the ship to address. The Individual Tax Return Extension Form for Tax Year 2021 is also due on this day. Division I of the Transportation Code was last amended by Ordinance 118-21 File No.

Eliminates the Payroll Expense Tax filed in 2022 for tax year 2021 Increases the Small Business Exemption ceiling to 2 million. Payroll Tax Limitation for Tax-Exempt Eligible Small Employers. Some municipalities have a lower tax rate for nonresidents.

Assessment of the Sales and Use Tax on Purchases. On July 8 Pennsylvania Governor Wolf signed into law HB 1342 which will reduce the corporate net income tax rate from 999 to 899 beginning on January 1 2023. This online version of the San Francisco Municipal Code last amended by Ordinance 188-22 File No.

151 Calle de San Francisco STE 200 San Juan PR 00901. Austin County has one of the highest median property taxes in the United States and is ranked 504th of the 3143 counties in order of median property taxes. The United States has adopted a progressive income tax system where your income is taxed at differing rates and the marginal rate is simply the highest rate you will pay.

Cook County collects on average 138 of a propertys assessed fair market value as property tax. Drafted by San Francisco 2021 2-50 Fordham 1197500 signing bonus 1469900 slot ML service. Regional Commissioner Michael Hirniak noted that the local rate of job gain 77 percent compared to the 45-percent national increase.

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City. For example San Francisco Denver. The Tax Cuts and Jobs Act reduced the top corporate income tax rate from 35 percent down to 21 percent.

Some jurisdictions may offer a credit for taxes paid to another locality. The tax is 38 as of 2021. Youll often find local taxes added to your employment tax requirements.

The city of San Francisco. Giants free agent signings 1991-2022. Proposition F was approved by San Francisco voters on November 3 2020 and became effective January 1 2021.

Derived principally from tax reports which are submitted by employers who are covered under state unemployment insurance UI laws. The bill will also phase the.

San Bernardino County Fire Protection District

As Coronavirus Hits Vatican Revenue Pope Cuts Pay For High Ranking Clerics The New York Times

San Bernardino County Fire Protection District

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

The 2021 Career Launching Companies List

Pin By Keanu Reevespersonalhandle On Places To Visit In 2022 Keanu Reeves Interview Keanu Reeves Life Keanu Reeves

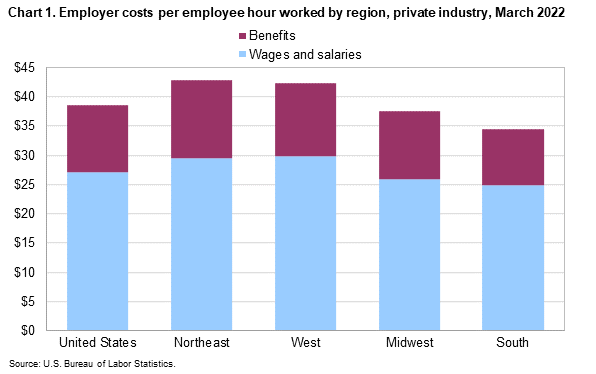

Employer Costs For Employee Compensation For The Regions March 2022 Southwest Information Office U S Bureau Of Labor Statistics

California Makes Favorable Changes To The Passthrough Entity Tax Sensiba San Filippo

Apple And Amazon Q2 Earning Reports Incoming Can This Impact Crypto In 2022 Business Development Stock Market Index Job Posting

You Re Not Wanted Here Advocates Decry Barriers Around San Jose Homeless Camp San Jose Spotlight

:max_bytes(150000):strip_icc()/Screenshot2021-11-09at11.35.14-7476aa727d4c4dae82727b2800eb6234.jpg)